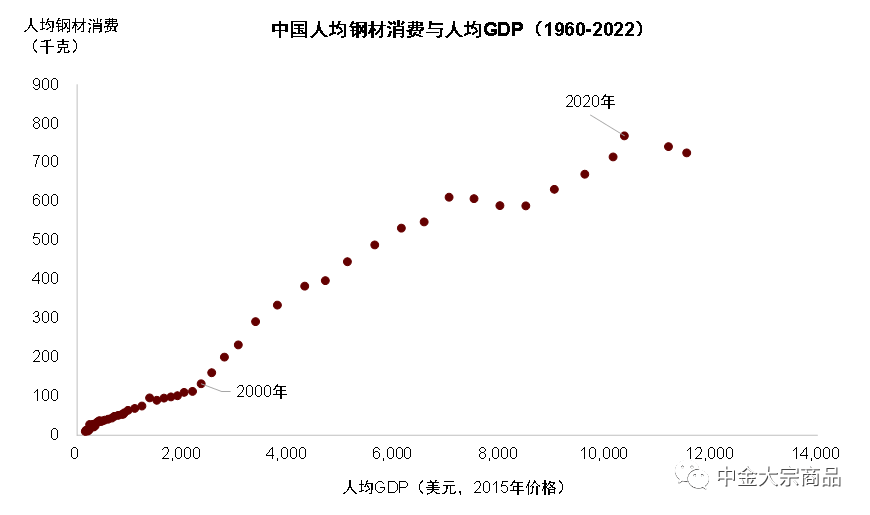

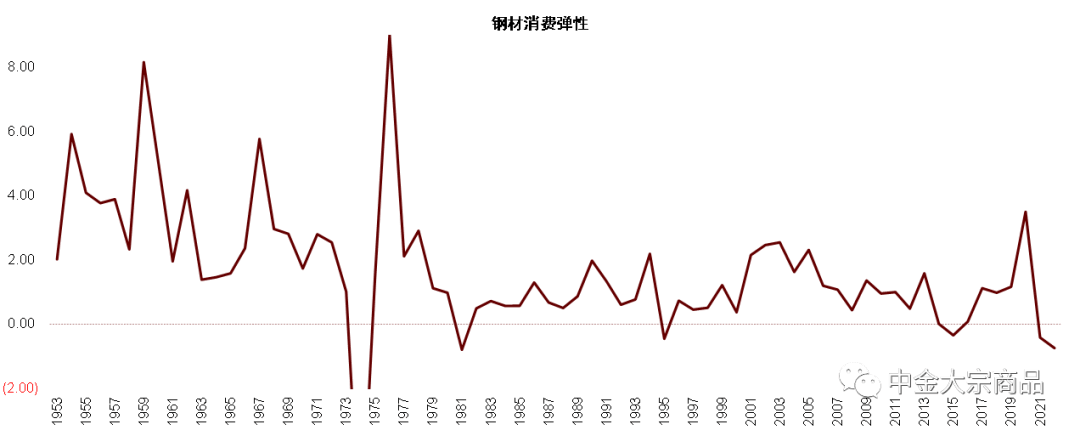

After two consecutive years of decline, we expect China's crude steel output to rebound slightly this year, thanks to the surge in external demand and the stabilization of domestic demand. However, from a long-term perspective, we still maintain our judgment that China's per capita steel consumption has basically peaked. China's crude steel production has been on a continuous upward trend since 1981 (during this period, only 2015 saw a negative growth rate), mainly driven by urbanization based on real estate and infrastructure, as well as investment and export-oriented industrialization. But as put forward at the Politburo meeting in July this year, "the relationship between real estate supply and demand has undergone major changes." We believe that China's housing demand has most likely peaked and entered a downward cycle. After urbanization enters the final stage, there will be limited space for new additions to traditional infrastructure. This may mean that China may have passed the second inflection point of the S-shaped curve of steel demand,entering the platform area。

Under the drag of real estate, the upper limit of demand still restricts the upward space of prices. Profits at the midstream smelting end are under pressure in both directions. Active destocking has alleviated the short-term contradiction between production and demand, but long-term pressure on the production capacity end still exists. After passing the inflection point of demand and entering the platform area, the logic of the three new industrial main lines has gradually become clearer, and may become the main driving force for this year and the next.

While the economy is growing, domestic steel consumption is basically following suit. However, international experience shows that steel consumption is not without an upper limit. After crossing the peak, we expect that the elasticity of steel consumption may tend to fall back. From a bottom-up perspective, the growth in real estate demand for steel has basically entered a negative contribution zone. The nature of countercyclical adjustment of infrastructure also determines that its sustainability may be limited. The demand points of the manufacturing industry are relatively scattered, making it difficult to form a centralized drive, and it is difficult for the increase to completely offset the decrease.

However, we also believe that the decline in

downstream demand should be step-by-step rather than a cliff-like

decline. Steel consumption fluctuating around a center may become the

new normal in the medium term.

1) The scale of the current stock of real

estate projects is still large, and new construction starts may

rebound to near the long-term center after oversold;

2) Infrastructure such as water conservancy

and urban village renovation are still the key to stable growth and

meet the infrastructure needs in the middle and late stages of

urbanization;

3) China’s manufacturing industry is still

large-scale. There are also many bright spots in new demand, such as

scenery installation, section steel, etc. We predict that actual steel

consumption will increase by -1.8% and 0.5% year-on-year respectively

in 2023 and 2024.

In particular, the main increase in demand this year is external demand that comes from "price-for-volume". Although the supply pressure and contradiction between supply and demand seem limited when steel inventories are at historically low levels, this is the result of steel mills actively reducing production under low profits. In other words, we believe that excess pressure does not come from output, but from production capacity and low production self-discipline. The elastic space of steel production capacity utilization means that excess profits are difficult to sustain. Compared with inventory, profit is a more effective indicator that reflects the relative strength of supply and demand (fundamentals). The current profit ratio of blast furnaces is only 17%, showing that the overall excess pressure in the industry still exists. From a vertical comparison, the profit margin of the steel industry is also much lower than that of the upstream industry.

The current profit dilemma has not led to the clearance of production capacity. The pressure on production capacity may continue unabated, and the peak production of replacement production capacity may be reached in the next few years. According to the Metallurgical Information Planning Institute, 190 million tons of iron-making output and 220 million tons of steel-making capacity will be put into operation from 2023 to 2025. If the reduction and replacement is strictly implemented and the old equipment is withdrawn in time, the impact on the net increase in production capacity may be small, but the production efficiency of the new equipment will be higher and the proportion of electric furnaces will be larger. The production capacity of midstream smelting is relatively abundant and less concentrated than that of upstream, and there is also the risk of excess in the face of downstream demand. Therefore, we believe that midstream smelting may be relatively weak in profit distribution, and its profit improvement may depend on strict output restrictions and production capacity. Elimination or merger and reorganization. However, in the short term, the commissioning of large-scale new production capacity may make production capacity management more difficult, so external production reduction may be an option. In the long term, we believe that "carbon peaking and carbon neutrality" will become the starting point for production capacity optimization.

In 2024, domestic demand will still face unfavorable factors such as shrinking real estate stock, but fiscal increases may continue to support steel demand. Demand is expected to pick up in Europe, the United States, Japan and South Korea, but the resumption of overseas production capacity may make steel exports face competition, and it may be difficult to balance both volume and price. Domestic steel mills' profits will face two-way pressure, and adjustments to output or capacity may be optional. We expect domestic demand to rebound slightly in 2024, crude steel production to remain flat year-on-year, and pig iron production to decline slightly. Globally, India and Southeast Asia may gradually become sources of incremental demand for iron ore and coking coal. Growth expectations for mainstream mine output coexist with supply uncertainty, and it is difficult to say that the iron ore balance will be significantly loosened. Coking coal also faces competition for imported resources, and seaborne coal prices may provide marginal support. Judging from the price performance, the black series will still be in a state of high and low next year.

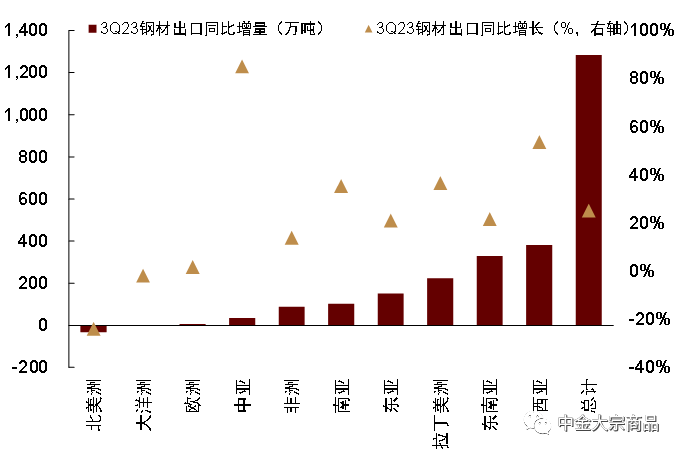

The biggest support for steel production and demand to exceed expectations is still external. We predict that steel exports may reach 90 million tons this year, with a year-on-year growth rate of 34%. Factors such as the weakening of domestic steel prices and the depreciation of the RMB have improved the cost-effectiveness of steel exports. On the other hand, the growth of fixed investment in infrastructure and manufacturing in Southeast Asia, the Middle East and other regions has driven demand for upstream processed products, and may face a periodic steel production capacity gap. Therefore, while economies such as the United States and Europe have significantly raised interest rates this year, exports to Belt and Road regions such as the Middle East, Latin America, and Southeast Asia have actually contributed to the main increase in steel exports.

It is expected that crude steel output in 2024 may decline by 1% year-on-year to 1.035 billion tons. In terms of the inventory cycle, the steel industry is still bottoming out, and there has been no further reduction in raw material and steel inventory this year. However, if there is no significant recovery in profit or demand expectations, steel mills and trading links may not proactively replenish inventories. We predict that the industry may still operate with low inventories next year.

In terms of real estate, although the market has responded to and digested the downward headwinds in real estate through low inventory and low production, we believe that the drag on demand by real estate may not be over yet. It is undeniable that next year, urban villages will be renovated and affordable housing will be actively promoted and the superimposed housing construction policy will be further optimized. The investment side and newly started construction area may usher in a certain improvement in the second half of the year. However, the volume of real estate stock construction area in the past two years has delayed the decline in steel consumption. However, this year's completion has increased year-on-year, and more stock projects have gradually entered the completion stage. The trend of real estate steel demand next year may still depend on the contraction of stock demand and the The relative speed of incremental release and the negative impact of the shrinkage of real estate projects under construction on demand cannot be ignored. In addition, supply-side credit risks still need to be properly resolved and handled, there is still a certain pressure on the investment activities of real estate companies, and new construction projects may still face certain risks.